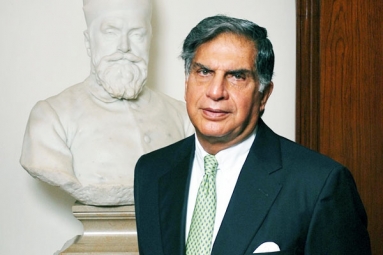

(Image source from: x.com/RNTata2000)

Ratan Tata, the former chairman of Tata Sons, is a highly influential industrialist, even though he has never appeared on billionaire lists. The Tata Group diversified significantly under his leadership, expanding from salt to steel, software, automobiles, and aviation. Despite controlling over 30 companies across the world, Ratan Tata lived a humble life. As a dedicated philanthropist, he followed in the footsteps of his great-grandfather, the founder of Tata, by believing that businesses should serve the communities they operate in. According to the IIFL Wealth Hurun India Rich List of 2022, Ratan Tata's estimated net worth is ₹3,800 crore, ranking him 421st on the list. The Tata Trusts, which hold a majority stake in Tata Sons, have inherited the assets of the Tata Group chairmen, with approximately 60% of the dividends from Tata Sons being allocated to charitable causes. Under Ratan Tata's leadership, the Tata Trusts established and expanded 10 cancer care facilities in several states, making world-class treatment accessible to underprivileged individuals.

Ratan Tata, the former chairman of Tata Sons, dedicated his time to educational initiatives across India. After retiring, he started supporting young entrepreneurs and investing in innovative, technology-driven startups that are shaping India's future. Tata personally and through his investment company, RNT Capital Advisors, invested in over 30 startups, including Ola Electric, Paytm, Snapdeal, Lenskart, and Zivame. He was also a dog-lover and ensured that stray dogs outside the Tata conglomerate's headquarters in Mumbai were provided shelter. Many Tata group stocks have delivered substantial returns over the past two decades, with some companies achieving over 100 times returns. Analysts credit Ratan Tata's 50-year career at the Tata group as a key factor that helped the conglomerate reach a market value of $365 billion by the end of March 2024, making shareholders and investors wealthier.

The group bought several well-known Tata companies under his leadership, including Tetley, Corus, Jaguar Land Rover, Brunner Mond, General Chemical Industrial Products, and Daewoo. His choice to introduce the Tata Nano, a car priced at just Rs 1 lakh, was unprecedented for that time. Ratan Tata significantly contributed to India's growth and enabled ordinary investors to benefit from his visionary leadership. Investors can learn from the Tata empire's success that a long-term investment approach is crucial to achieve substantial wealth creation in the stock market. Although current market conditions may raise valuation concerns, exceptional companies like those built by Ratan Tata can provide investors with significant returns over the long run. Over the past 20 years since TCS's listing, Titan Company's stock price has soared by an extraordinary 50,834%, making it a remarkable investment. This success also helped the late investor Rakesh Jhunjhunwala become a multi-billionaire, with his wife still owning Titan shares worth over Rs 16,651 crore. Jhunjhunwala himself was in awe of Ratan Tata, recognizing the philanthropy of the Tata founders, Sir Ratan Tata and Sir Jamsetji Tata.

The Tata group has made significant contributions to India's development. They have established the country's first steel plant, hotel, power plant, software company, and car manufacturer. The Tata Institute of Science was also founded by them. The Tata group has recently acquired Air India for $2.4 billion, which Jhunjhunwala sees as a noble and wealth-creating endeavor for society. Tata companies like Trent Ltd, Voltas Ltd, and Tata Elxsi have delivered exceptional returns for investors over the past 20 years. Ratan Tata took over as the Chairman of Tata Sons and the Tata trusts in 1991, leading the group's continued growth and impact.

In 2012, Ratan Tata left his position as Chairman of Tata Sons after 50 years with the company, and was given the title of Chairman Emeritus. Several Tata group companies, including Artson Engineering, Rallis India, and Tata Consultancy Services, provided investors with significant returns over the past two decades. Additionally, other Tata stocks, such as Nelco, Tata Consumer Products, and Tata Motors, have delivered moderate to high returns during this period. Beyond listed companies, Tata has also invested in various start-ups, including Upstox, Lenskart, and Paytm Mall.