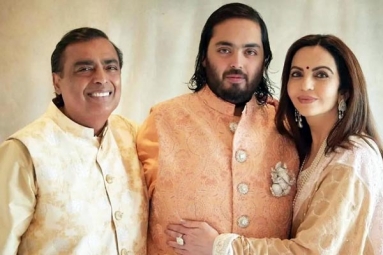

(Image source from: REUTERS)

Mukesh Ambani-led Reliance Industries Ltd (RIL) is seeking a $3 billion (about Rs 25,500 crore) loan, the largest offshore loan from India in a year, and is in talks, according to Bloomberg Banks. was reported. Mumbai-based RIL is in talks with about half a dozen lenders to consolidate its "broader market" lending by the first quarter of 2025. The terms of the loan and Reliance's intention to repay the outstanding balance are not final and may change. According to the report, the company accumulated about $2.9 billion in debt over the next year. The loan would mark RIL's return to overseas markets as the conglomerate racked up $8 billion (about Rs 700 crore) in debt last year, which at the time. was a record for an Indian borrower. About 55 banks were involved in lending to Reliance as lenders sought high-profile loan deals.

The new debt report saw the Indian rupee further weaken against the US dollar in November, pushing local stocks to record highs. Reliance is currently one notch above India's sovereign rating, making it rare for a company to have a higher credit rating than its home country. Last week, Moody's affirmed RIL's 'Baa2' rating and said the group's credit rating is 'solid' and will remain so 'despite continued capital expenditure'.